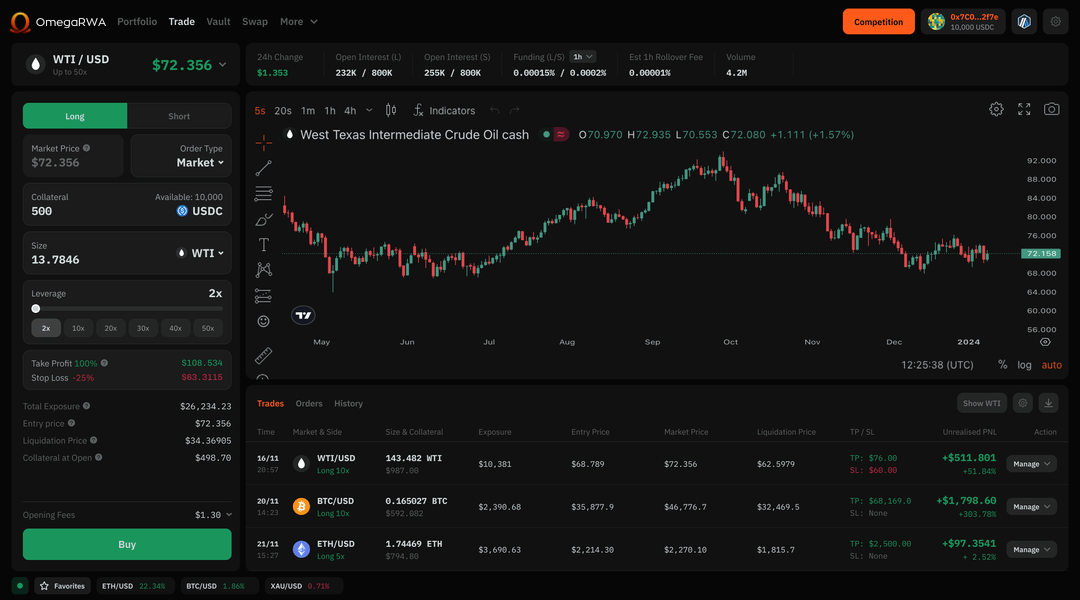

Onchain Perps

for Real World Assets

Business Features

Crypto Rails. Traditional Assets.

Your whole portfolio. Onchain.

Gain exposure to everything from Oil and Gold to Lean Hogs and exotic Forex—now onchain with Solana. For the first time, trade real world assets alongside burgeoning sectors like memecoins.

Trade on macro signals.

Inflation. Rising interest rates. Volatile geopolitics. Adapt to the new macro paradigm with event-based trading on a blockchain built for speed and efficiency.

Fractional, flexible exposure.

Begin with as little as $10. Omega RWA’s virtual price exposure allows users to engage with traditionally large-scale markets without the constraints of traditional commodities markets.

Problem and solution

Real World Assets Need

a Purpose Built Solution

Built for traders on Solana

While existing tokenized asset solutions cater to long-term investors, our perpetual contracts are specifically designed for the dynamic needs of traders on the Solana blockchain.

Markets close

Traditional markets are not always open. Onchain exchanges on Solana include safeguards against erroneous pricing when markets are closed.

Futures roll

Our perpetual indices on commodities account for next-month rolls to prevent front-running, ensuring smooth transitions through discrete futures trading.

Ready to Trade?

Sign up and get whitelisted for priority access to our Beta.

Feedback

Pre-Sale.

We'll Build it.

Our team prioritizes the features you care most about.